Last month General Motors clarified and expanded its EV strategy, inviting reporters to the GM Design Dome in Warren, Michigan.

Keynoting the event, Mary Barra, BM chairman and CEO said, “Our team accepted the challenge to transform product development at GM and position our company for an all-electric future. What we have done is build a multi-brand, multi-segment EV strategy with economies of scale that rival our full-size truck business with much less complexity and even more flexibility.”

At the heart of GM’s strategy is, like other global manufacturers, a modular propulsion platform—now in its third generation—and proprietary “Ultium” batteries developed in cooperation with LG Chem. This is a $2.3 billion battery cell manufacturing plant in Lordstown, Ohio. These Ultium batteries are unique, GM says, as they were developed as pouch-type cells that can be stacked vertically or horizontally. This is important as it allows freedom to design optimized energy storage and layout for each vehicle, versus a standardized platform.

Battery packs, the heart of every electric vehicle, will be assembled into packs producing from 50 to 200kWh of energy. For comparison, Audi’s e-tron 55 has a 95 kWh battery; a Tesla’s batteries have been 85-100+kWh and Ford’s Mach-E offer 75- and 98-kWh batteries. GM promises estimated ranges of 400 miles—or more—on a full charge with 0-60 acceleration under three seconds in some cases.

All platforms will use GM-designed electric motors fitted to front-wheel drive, rear-wheel drive, all-wheel drive and performance all-wheel drive vehicles. All platforms will be designed for fast DC charging, most with 400-Volt battery packs and up to 200kW fast-charge capability.

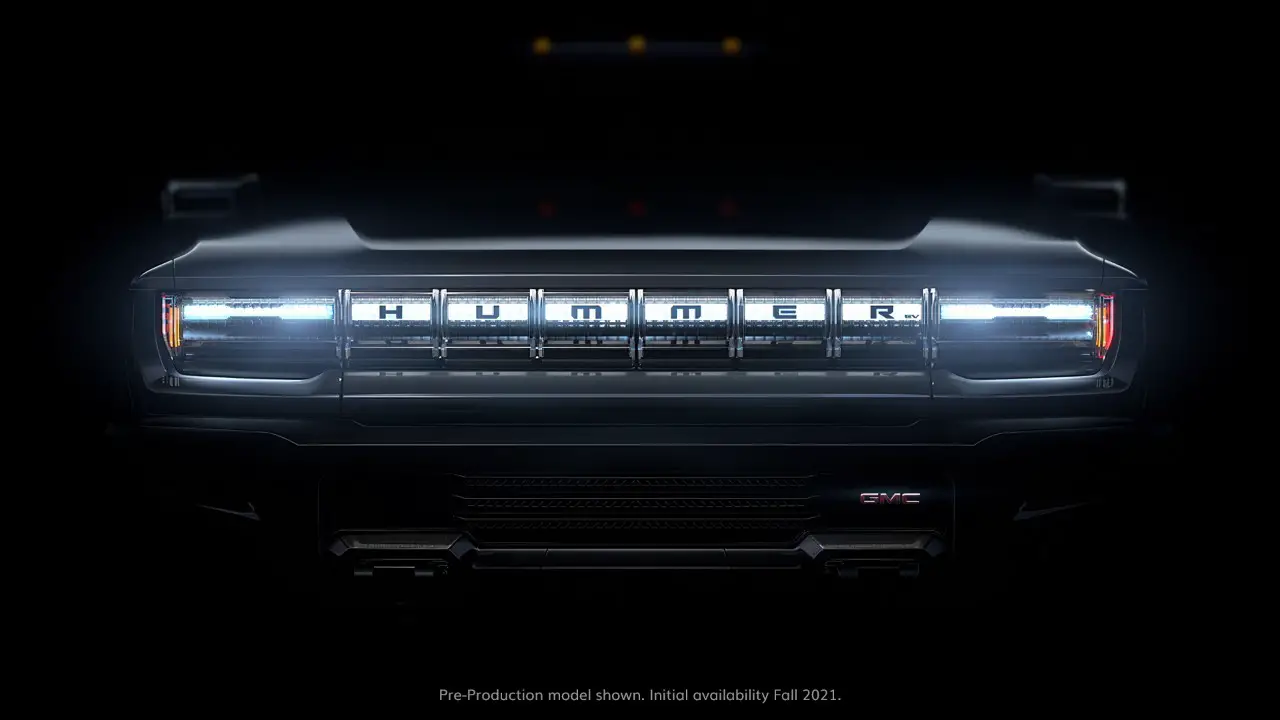

Truck platforms will have 800-Volt battery packs and 350 kW fast-charge capabilities. The Ultium battery powered GMC Hummer EV is promised to debut on May 20. Whether this is the first of GM’s all-electric pickup trucks, with a production date of late 2021, wasn’t mentioned.

These are global platforms, which GM says means the company can spend less to scale its EV business through leveraging current assets like plants, tools and production equipment like paint and body shops. Note that the Detroit-Hamtramck Assembly Plant, a 100-percent EV facility, represents a $2.2 billion investment.

These are global platforms, which GM says means the company can spend less to scale its EV business through leveraging current assets like plants, tools and production equipment like paint and body shops. Note that the Detroit-Hamtramck Assembly Plant, a 100-percent EV facility, represents a $2.2 billion investment.

The company notes that EV propulsion systems are far less complex than ICE-powered vehicles and the company plans a mere 19 different “battery and drive unit configurations initially, compared with 550 internal combustion powertrain combinations available today.”

GM says it can rapidly scale production if demand exceeds the projected 1 million global sales expected by mid-decade. Note that external forecasters predict North American EV volumes in the 2025-2030 timeframe to be about 3 million units.

The first new Chevrolet EV will be an updated Bolt EV in late 2020, launching this summer with the once Cadillac-exclusive Super Cruise Advanced Driver Assist system. It will be preceded by the Cadillac Lyriq luxury SUV, which was to be shown in April. Chevrolet, Cadillac, GMC and Buick will all launch new EVs beginning later this year with expansion to ten new/improved/updated vehicles “by next year”. By 2023, GM says it will offer 22 electric vehicles.

GM says the new platform, which supports the Cruise Origin self-driving shared vehicle shown in January 2020 in San Francisco, is the first on this third-generation platform. Ultium battery cost, which use low cobalt chemistry, GM promises will be driven below $100/kWh. At this price, an EV powertrain and ICE powertrain are nearly identical in cost. GM also expects to license the partnership’s battery technology.

GM isn’t alone in pursuing electrification. Note that Volkswagen Group has promised a financial commitment of €33 billion and plans to produce 1.5 million electric vehicles as early as 2025. To do so, the company is investing that €33 billion across the Group (Audi, Seat, Skoda, Bentley, Bugatti, Porsche, Lamborghini, Volkswagen, et al) by 2024. VW itself plans to: invest more than $66 billion USD in EVs, digitalization and new mobility services by 2023; to sell 26 million electric vehicles—globally and group-wide—through 2029 and more than a million EVs by 2024; globally and group-wide, Volkswagen intends to sell 75 new EV models over the next decade.

Ford, already a development partner with VW, has said that, in addition to the Mach-E, it has “made a commitment to reduce CO2 emissions consistent with guidelines in the Paris Climate Accord that includes investing more than $11.5 billion in electric vehicles. To increase the appeal and adoption of electric vehicles, Ford is introducing zero-emissions versions some of its most successful vehicles, including the Mustang Mach-E later this year and an electric F-150 in the near future. The company also recently launched North America’s largest EV charging network.