General Motors is reporting a mixed bag of results for the third quarter of 2024, with some segments performing well and others showing notable declines. GM truck enthusiasts, in particular, will want to dig into the numbers to see where GM’s bread-and-butter models stack up. So, let’s cut through the noise and get straight to the key takeaways.

1. Full-Size Truck Sales: A Dominant But Slightly Shaky Position

GM still maintains a stronghold on full-size pickups, boasting the #1 spot in total sales year-to-date — a trend that has held since 2007. But it wasn’t a stellar quarter for the Silverado line. The Silverado HD saw a 22.4% drop in Q3 deliveries compared to last year, with a volume of 41,979 units versus 54,071 units in Q3 2023. The Silverado LD, however, stayed mostly flat, at 85,190 units sold — just a 0.1% dip.

On the upside, Silverado EV sales are gaining momentum, up dramatically year-over-year, with 1,995 units moved this quarter compared to only 18 units in Q3 last year. If GM can keep up production, the EV side of the Silverado lineup might garner more significant sales in 2025..

The Sierra fared better, especially the light-duty model, which saw a notable 17.6% increase in sales to 52,647 units, compared to 44,769 last year. Overall, GMC’s truck sales are up 10.1% for the quarter, with 80,613 units moved.

2. Mid-Size Trucks: A Comeback for Colorado and Canyon

It’s been a strong quarter for GM’s mid-size truck segment. The Chevy Colorado and GMC Canyon both posted solid gains — 13.2% for the Colorado (to 28,887 units) and a 32.7% rise for the Canyon (to 10,121 units). This performance is the best Q3 the Colorado has had since 2019.

For truck enthusiasts, these numbers reflect increased interest in smaller trucks, possibly driven by the refreshed models and expanded feature sets that now appeal to both everyday drivers and off-roaders.

3. Heavy-Duty Trucks: A Segment Under Pressure

While the Sierra HD held its ground, slipping just 3.1% (to 27,579 units), the Silverado HD struggled significantly with a 22.4% decline. A chunk of that might be due to increased competition in the heavy-duty space and the ongoing shift toward lighter-duty models that offer similar power without the weight penalty.

4. EVs: Early Signs of Traction

GM is aggressively pushing its electric lineup, and Q3 shows it’s starting to pay off — EV sales hit 32,095 units, up 60% year-over-year. Notably, 50% of these EV buyers were new to GM, which could signal a turning point for the brand’s efforts in the electric space.

The Equinox EV had a strong debut, selling over 9,700 units in its first full quarter. The Blazer EV also saw solid growth, with 7,998 units delivered. However, the Bolt EV and EUV have been practically phased out, dropping a staggering 98.9% year-over-year. This seems to be part of a broader strategy to pivot away from the older Bolt platform toward newer Ultium-based models like the Silverado EV and upcoming Sierra EV.

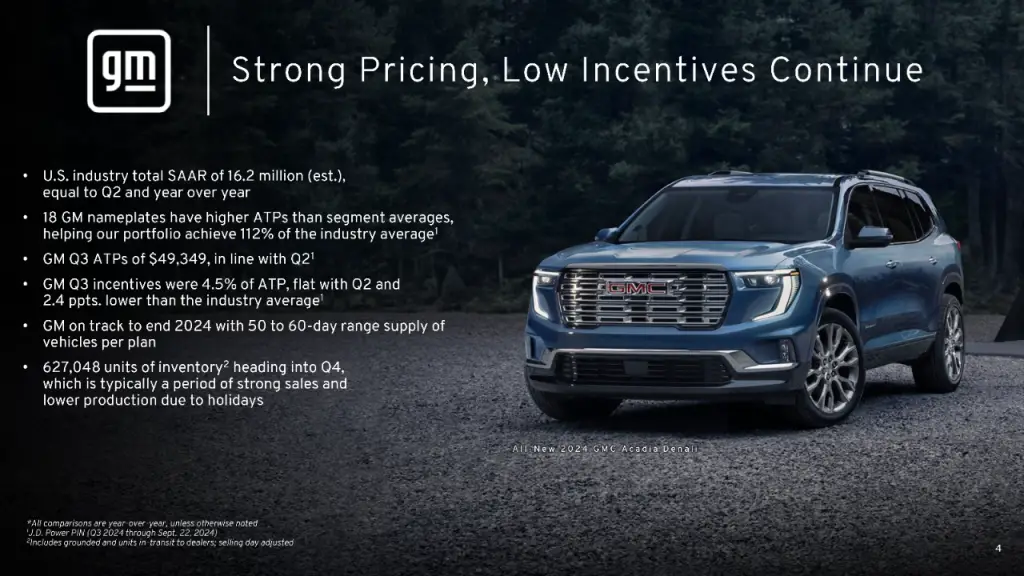

5. Inventory and Pricing: A Balancing Act

Inventory levels are stable, with GM reporting 627,048 units available, including in-transit vehicles. This will be crucial as we head into Q4, typically a strong sales period with holiday incentives coming into play. On the pricing side, GM’s average transaction prices (ATPs) were $49,349, consistent with Q2, and incentives stayed low at just 4.5% of ATP, below the industry average.

For truck owners, this means GM is holding its pricing discipline, so don’t expect deep discounts, especially on popular trims like the Denali or AT4.

GM Q3 Earnings – The Bottom Line

If you’re a GM truck enthusiast, the takeaway is a mixed one. The Silverado and Sierra lines are still dominant, but there’s clear pressure in the heavy-duty segment, and EVs are becoming an increasingly significant part of GM’s strategy. With competitive pricing and new models set to hit in Q4, it’ll be worth watching how GM balances traditional powerhouses like the Silverado HD with its growing electric ambitions.

For now, it’s a tale of two worlds: conventional trucks holding their own, while electric models build early momentum. The truck wars are far from over — and GM is playing a long game.

GM Q3 2024 Vehicle Sales by Brand

Chevrolet

- Blazer: Q3 – 11,057 | YTD – 40,545

- Blazer EV: Q3 – 7,998 | YTD – 15,232

- Bolt EV / Bolt EUV: Q3 – 168 | YTD – 8,582

- Camaro: Q3 – 444 | YTD – 5,750

- Colorado: Q3 – 28,887 | YTD – 70,710

- Corvette: Q3 – 7,797 | YTD – 25,711

- Equinox: Q3 – 37,068 | YTD – 143,523

- Equinox EV: Q3 – 9,772 | YTD – 10,785

- Express: Q3 – 13,338 | YTD – 30,250

- LCF: Q3 – 937 | YTD – 4,114

- Malibu: Q3 – 24,424 | YTD – 93,533

- Silverado HD: Q3 – 41,979 | YTD – 129,668

- Silverado LD: Q3 – 85,190 | YTD – 269,936

- Silverado MD: Q3 – 2,133 | YTD – 7,540

- Silverado EV: Q3 – 1,995 | YTD – 5,252

- Total Silverado: Q3 – 131,297 | YTD – 412,396

- Suburban: Q3 – 9,049 | YTD – 30,512

- Tahoe: Q3 – 23,337 | YTD – 71,780

- Trailblazer: Q3 – 29,609 | YTD – 81,708

- Traverse: Q3 – 28,390 | YTD – 69,852

- Trax: Q3 – 59,299 | YTD – 149,762

- Chevrolet Total: Q3 – 422,871 | YTD – 1,264,745

GMC

- Acadia: Q3 – 14,455 | YTD – 32,137

- Canyon: Q3 – 10,121 | YTD – 26,956

- HUMMER EV (Pickup & SUV): Q3 – 4,305 | YTD – 8,902

- Savana: Q3 – 6,876 | YTD – 14,355

- Sierra HD: Q3 – 27,579 | YTD – 75,091

- Sierra LD: Q3 – 52,647 | YTD – 153,920

- Sierra EV: Q3 – 387 | YTD – 387

- Total Sierra: Q3 – 80,613 | YTD – 229,398

- Terrain: Q3 – 16,164 | YTD – 65,287

- Yukon: Q3 – 19,331 | YTD – 58,793

- GMC Total: Q3 – 151,865 | YTD – 435,828

Buick

- Enclave: Q3 – 5,161 | YTD – 19,148

- Encore: Q3 – 0 | YTD – 126

- Encore GX: Q3 – 14,675 | YTD – 44,646

- Envision: Q3 – 12,565 | YTD – 34,425

- Envista: Q3 – 15,004 | YTD – 38,890

- Buick Total: Q3 – 47,405 | YTD – 137,235

Cadillac

- CT4: Q3 – 1,398 | YTD – 4,900

- CT5: Q3 – 4,128 | YTD – 10,991

- Escalade: Q3 – 8,788 | YTD – 27,992

- LYRIQ: Q3 – 7,224 | YTD – 20,318

- XT4: Q3 – 5,655 | YTD – 15,688

- XT5: Q3 – 5,679 | YTD – 17,844

- XT6: Q3 – 4,342 | YTD – 13,387

- Cadillac Total: Q3 – 37,214 | YTD – 111,120

GM Overall

- Total GM Q3 Sales: 659,601

- Total GM YTD Sales: 1,949,920