General Motors, through its OnStar Smart Driver program, has inadvertently sparked a significant debate over what data your vehicle is capturing, where it’s going, and who is getting access to it. As we found out, most of the time, drivers may not even know their vehicle is sharing their driving habits with others – including your insurance company.

UPDATE: 3/22/24 – IN STUNNING REVERSAL, GM STOPS SHARING VEHICLE DRIVING DATA WITH BROKERS

The OnStar Smart Driver Program: Intentions and Unintended Consequences

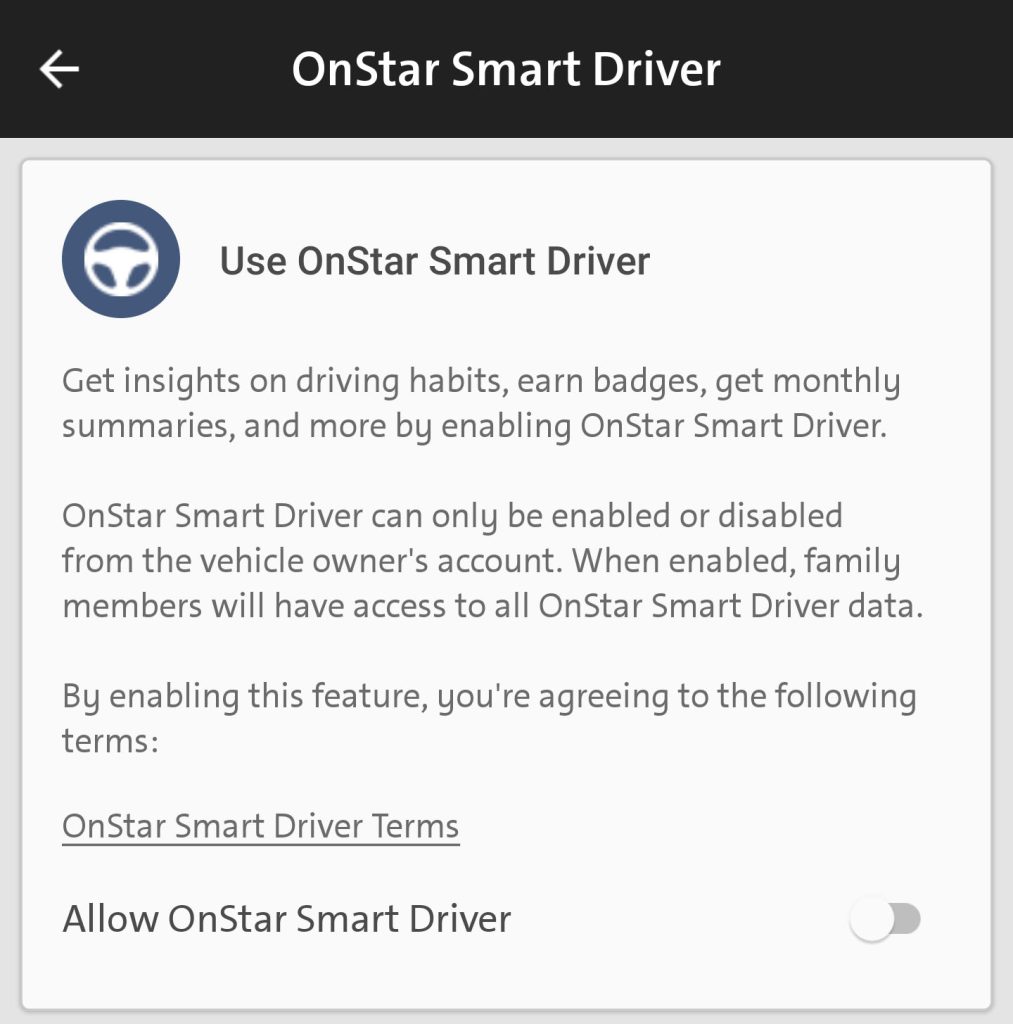

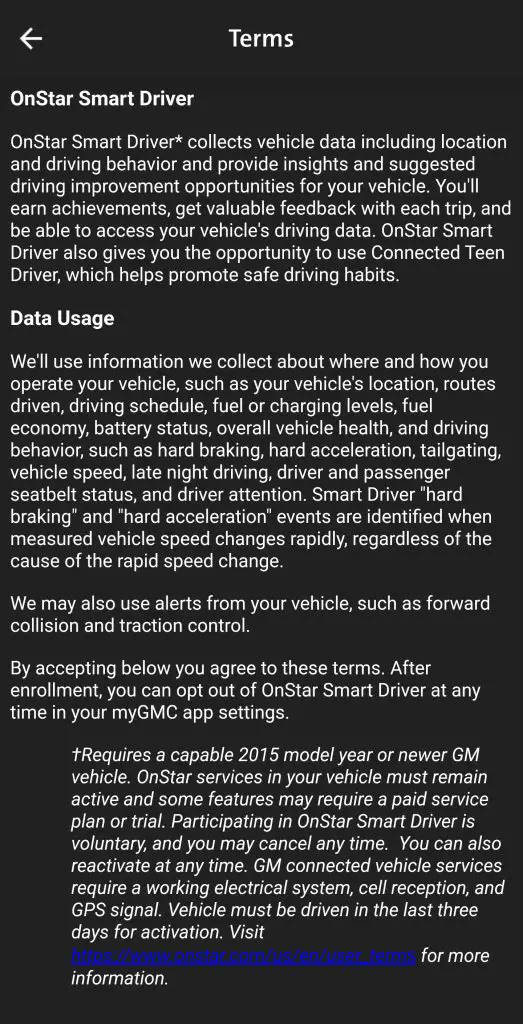

OnStar Smart Driver is an “opt-in” service offered by General Motors, designed to provide drivers with feedback on their driving habits with the aim of promoting safer driving behaviors. The service analyzes various aspects of driving performance, including hard braking, rapid acceleration, speed, traction control, following distance, and seatbelt usage, to offer insights that can help improve driving safety and potentially lead to insurance discounts.

However, the program has come under scrutiny for reasons that extend far beyond its original purpose. The data collected by OnStar Smart Driver is reportedly being sold to insurance companies through intermediary data brokers, a practice that has significant implications for vehicle owners. This detailed driving data, which includes metrics on acceleration, braking, speed, and more, is used by insurance companies to assess risk and personalize insurance rates.

For vehicle owners, this means that their driving habits, monitored unbeknownst to some, can directly influence their insurance premiums. While safer driving behaviors could potentially result in lower rates, any instances of hard braking, rapid acceleration, or speeding captured by Smart Driver could lead to increased insurance costs. This linkage between driving data and insurance rates introduces a new dimension of financial consequences for vehicle owners, based on the monitoring of their driving behaviors, often without their explicit consent or full understanding of the data’s use.

When the editors here at GM-Trucks.com first heard reports that some Chevrolet drivers were finding “Smart Driver” enabled within their OnStar accounts despite not signing up for the service, we were skeptical. I had personally turned it off when I purchased our Chevy Silverado, our GMC HUMMER EV, and my wife’s Buick Enclave. It was easy to do and we never found the service to be anything other than Opt-In. Even on their website for Smart Driver, OnStar states, “We do not auto-enroll customers into OnStar Smart Driver. All customers must opt-in to be enrolled.”

Somewhere along the line, things have changed, and now we find that isn’t necessarily true. When I opened the myGMC and myChevrolet app this week, I found not only was I enrolled in Smart Driver under my business account, which has active OnStar subscriptions in place, but also in my personal account, which does not have an OnStar Subscription active. All three of my vehicles, which I’ve never enrolled into OnStar Smart Driver, had the feature enabled. What the heck? Turns out I’m not alone. A quick look online shows we’re not the only GM vehicle owner that’s found the feature randomly enabled. There’s even discussion on if vehicles are transmitting data when Smart Driver is not enabled. Your vehicle may be sending driving information when Smart Driver is turned off or even when you don’t have an active OnStar Account subscription.

OnStar Data Collection and Sharing With Lexis Nexis

The crux of the controversy, both for us and the broader community, centers on the intricate driving data harvested by GM vehicles. This data, characterized by its meticulous detail on driving behaviors such as hard braking, rapid acceleration, and seatbelt usage, is funneled to data brokers, notably Lexis Nexis. As a global data brokerage and analytics firm, Lexis Nexis specializes in aggregating vast amounts of data and repurposing it for various industries, including the insurance sector.

By selling this detailed matrix of driving data to insurance companies, Lexis Nexis plays a pivotal role in how insurance risks are assessed and premiums are determined. Insurance providers leverage this data to tailor insurance rates more closely to an individual’s driving habits, directly linking personal driving behaviors to financial consequences for vehicle owners. This practice of detailed data collection and its subsequent sale to insurance companies through brokers like Lexis Nexis not only underscores the depth of surveillance modern drivers are subjected to but also highlights the profound implications such data sharing has on privacy and personal financial liability.

Community Reactions: A Spectrum of Concerns

The revelations about OnStar Smart Driver and data sharing have resonated deeply within the GM-Trucks.com community and beyond, highlighting a spectrum of concerns:

Accuracy of Data: Doubts about the reliability of the collected data have been raised, with discrepancies in seatbelt usage reports serving as a glaring example. Such inaccuracies not only undermine trust in the system but also have real-world implications for insurance assessments.

The Specter of Surveillance: The pervasive nature of modern connectivity has led to apprehensions about a “big brother” phenomenon, where personal freedoms are increasingly encroached upon by technological oversight.

Demand for Transparency: An article by Forbes underscores a significant demand for greater transparency from GM and other automakers regarding their data collection and sharing practices. The discovery that such detailed personal data is being commodified without explicit consent has left many feeling deceived.

The Right to Control Personal Data: Amid growing calls for the ability to disable or opt out of data collection systems, there is a clear desire among vehicle owners for more autonomy over their personal information and the technology embedded in their vehicles.

A Broader Context of Privacy Erosion: This issue is seen by some as symptomatic of a larger trend, where privacy is increasingly sacrificed at the altar of convenience and connectivity.

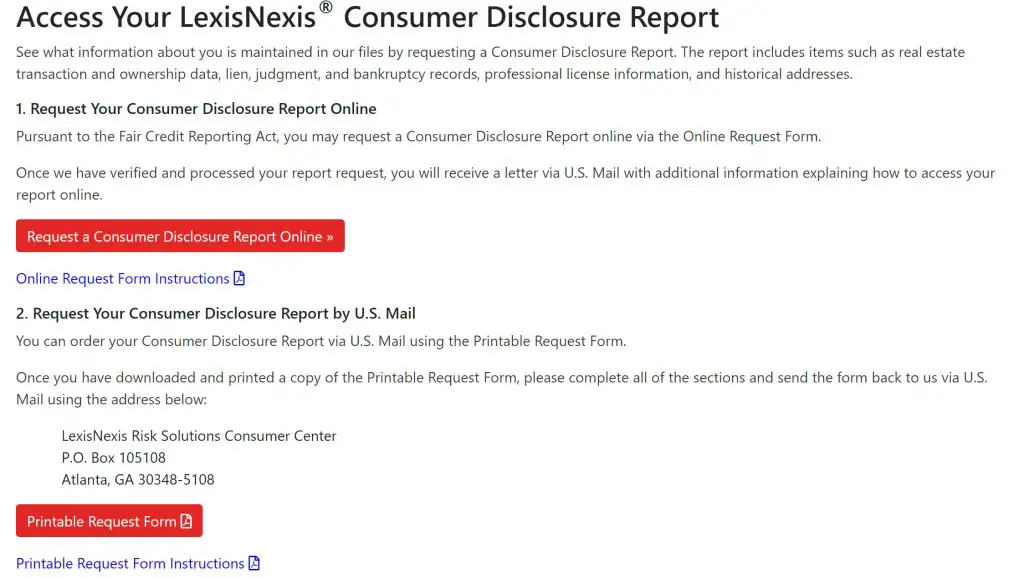

How to Request Your Data from Lexis Nexis

For individuals concerned about their privacy and the use of their personal driving data, there is a way to request what the data collection community knows about you. Lexis Nexis, as a data broker involved in this process, is obligated under the Fair Credit Reporting Act to provide individuals with access to their personal information upon request. To request your data, you can visit the Lexis Nexis Consumer Center website and follow the process for obtaining a “consumer disclosure report.” This report will provide a comprehensive overview of the information Lexis Nexis holds about your driving behavior, offering a starting point for those seeking to understand or contest the data that may be influencing their insurance premiums.

I’ve requested my data from Lexis Nexis and will share what the company knows about me and my driving habits when my report is provided.

Navigating Forward: A Call for Balance and Respect

The OnStar Smart Driver controversy is a stark illustration of the potential pitfalls that accompany the merging of technology, privacy, and personal freedoms within the automotive realm. As detailed in New York Times and Forbes articles, General Motors finds itself navigating a precarious landscape where the balance between innovation and individual privacy rights is at stake.

The controversy highlights the limited financial benefits derived from selling detailed driving data—Forbes reports them to be in the “low millions of dollars”—against the backdrop of potentially inciting customer dissent and eroding trust. In our opinion, this situation exposes GM to significant risks, including the possibility of a customer revolt that could have far-reaching consequences beyond immediate financial losses, such as long-term brand damage and diminished customer loyalty.

The lesson here for GM and the broader automotive industry is the paramount importance of upholding transparency, securing informed consent, and honoring privacy. Moving forward, it’s imperative for these companies to not only address the current concerns of their customers but also to establish new standards for ethical data handling that could serve as a benchmark across the industry.